If you’re in the startup world you’ll run across the startup curve,

rather frequently. The canonical

post on the

subject was done by Fred Wilson, but the original

concept came from a

talk

given by Paul Graham

It’s not earth shattering, but it does a good job of getting across

something that many people, who haven’t been there, don’t realize. Very

few successful ventures get to that point without some fluctuations on

the way.

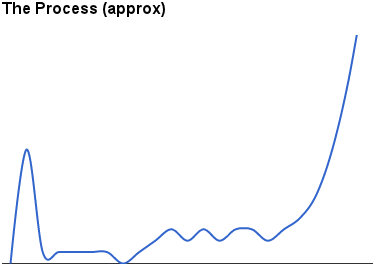

My quick-and-dirty approximation of “the” curve can be found to the

right. I haven’t added all of the requisite labels, you can check the

canonical post

for the details, but the curve itself should get across the basic idea.

There’s the Techcrunch launch, PG’s “Trough of Sorrow” as the startup

fumblingly goes from awesome idea to a real functioning, in the broader

sense, product. The magnitude could be users, revenue, buzz, it doesn’t

really matter, it’s just “success” in whatever form(s) are applicable.

I don’t have anything to add or change, that seems pretty reasonable to

me. Those guys have been around a lot more successes than I and are in a

much better position to talk about the full life cycle of a successful

startup.

I’m going to talk about other startup curves, the ones that are way more

common. After all startups have a ~90% failure

rate.

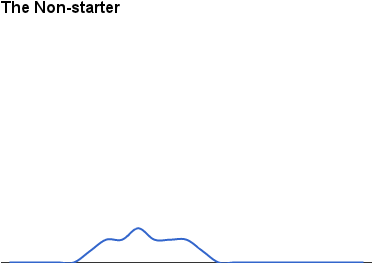

The first is the Non-Starter. It’s the common trajectory for ideas that

never get funded. A couple guys and an idea playing around in their

spare time. Maybe they get excited as things start to go up and leave

their day jobs, maybe they don’t, but either way the initial success is

short-lived and there’s bills to pay. Things aren’t going particularly

bad, but they’re not growing enough to get VC’s to bite and aren’t

having any luck with angels. There are some people using it, but there’s

not enough money to cover expenses so after giving it a decent go, the

plug is pulled and they move on. No harm, no foul.

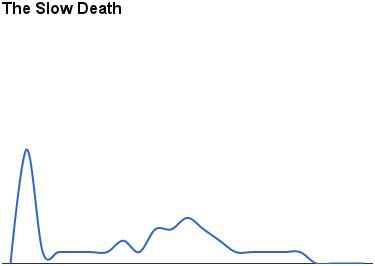

Up second is the slow death. Take a decent idea, add a seed round and

go… Venture beat is picking up the launch and the Valley is listening.

The first couple days are huge, everyone is on an adrenaline high, but

then reality sinks in. All those users weren’t really our target

demographic, they’re just techies/valley folks who read Techcrunch. They

check it out, tweet about how awesome it is and then never return.

A few weeks pass, no one is showing up now that the buzz has died down.

There’s a trickle and enough people around to make things sort of

interesting. This is the standard new idea problem. It’s a decent idea,

people like it if they see it, but you can’t get in front of (enough of)

the right people. The product isn’t viral and it’s good, but not

outstanding. There are successes, but big growth is elusive, the money

is running low and the VC’s aren’t knocking on the door.

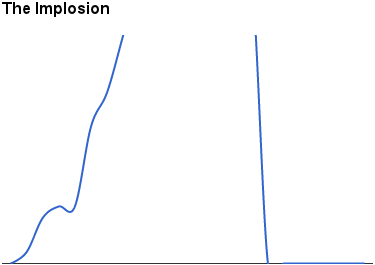

My final curve is a rarity, but it’s worth talking about b/c it’s

different. The implosion takes a CEO/E-team with bravado and then some,

really it takes a sociopath.

Color

is the most recent and largest example. The chart could track a lot of

things, but revenue isn’t one of them and users probably isn’t either.

It doesn’t matter what the product is or how well it work. The CEO has

VC’s hanging on every word and writing blank checks. They launch

something, there’s enough talk that lots of people are checking it out,

maybe even liking what they see. How they going to make money, who

cares, “it’s gonna be huge.”

Bully for them, but if they don’t get an exit quickly there’s an

apocalyptic event on the horizon. A reality check, the hype bubble

bursts. It can happen after the acquisition or before, it’s just a

matter of who’s left holding the pieces, the VC’s or the acquiring

party.

This post is meant mostly in jest, but the serious point I want to make

is that just because you had a big launch and now are going through some

“sorrow” it doesn’t mean you’re on track for success, following the

startup curve. You may very well be going through the same process, but

that doesn’t mean you’re going to see the growth on the other side.